By Thomas Paulson, Head of Market Insights

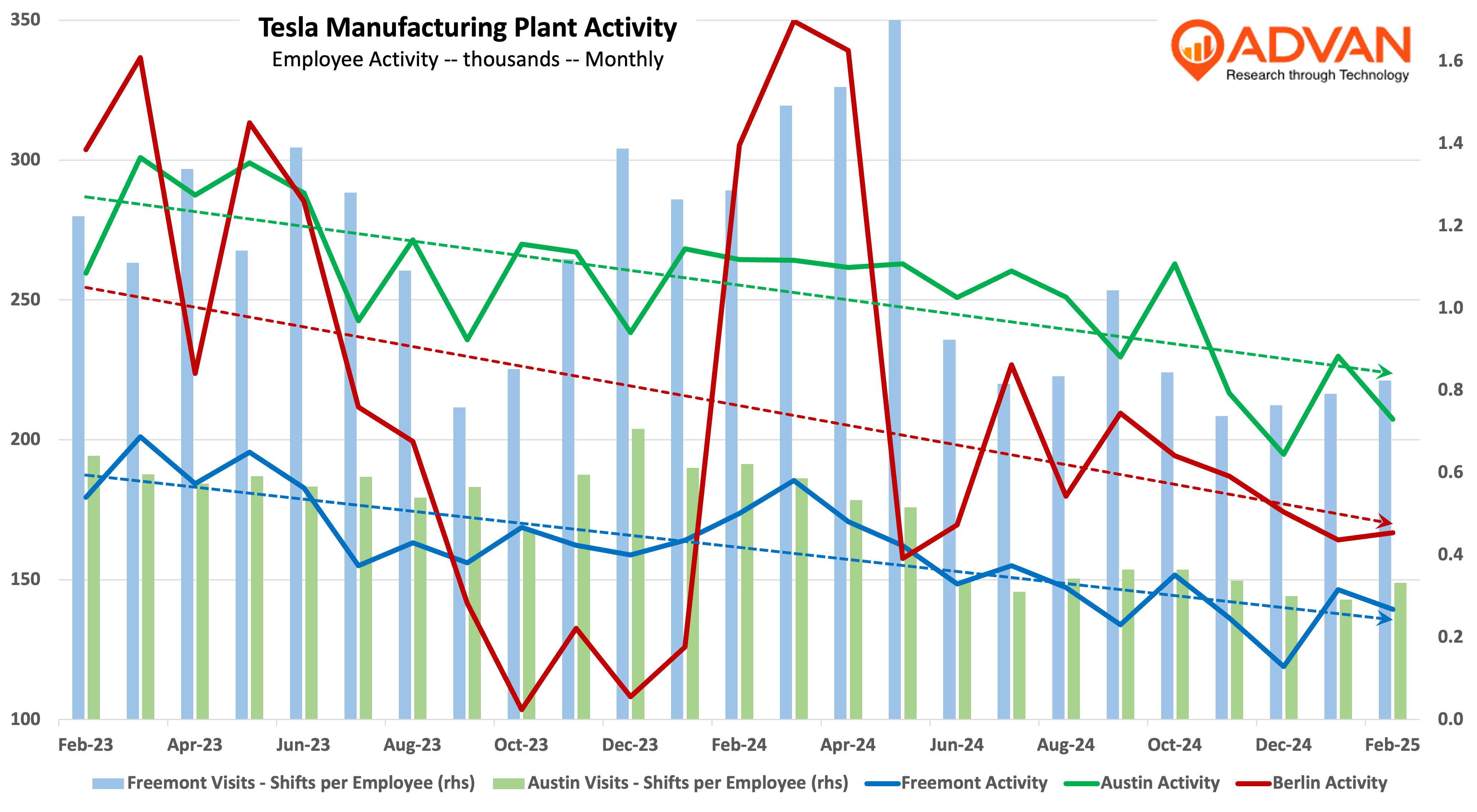

Production activity at Freemont, Austin, and Berlin has stepped meaningfully lower in February, accentuating the negative trend at year end. Clearly, Tesla’s sales and operations team are observing a slackening in demand, confirming industry and press reports, and cutting production to manage inventory levels down. Industry watchers Wards and Motor Intelligence peg deliveries at flat in the US through February (they should have been up due to an easy comparison); related research from Goldman Sachs shows deep declines in purchase intent for Tesla vs the Detroit-3. Similarly, registration data for Europe shows steep declines for January + February per CNBC. As in relates to Europe (and China for that matter), not all of the decline is attributable to sentiment towards Musk and the Tesla brand, some of it is significant inroads being made by China EV brands like BYD which have persistently introduced new models, which include that latest and greatest technologies as no added cost (or trim enhancements). By contrast, Tesla has yet to introduce a new model in these markets since before the pandemic.

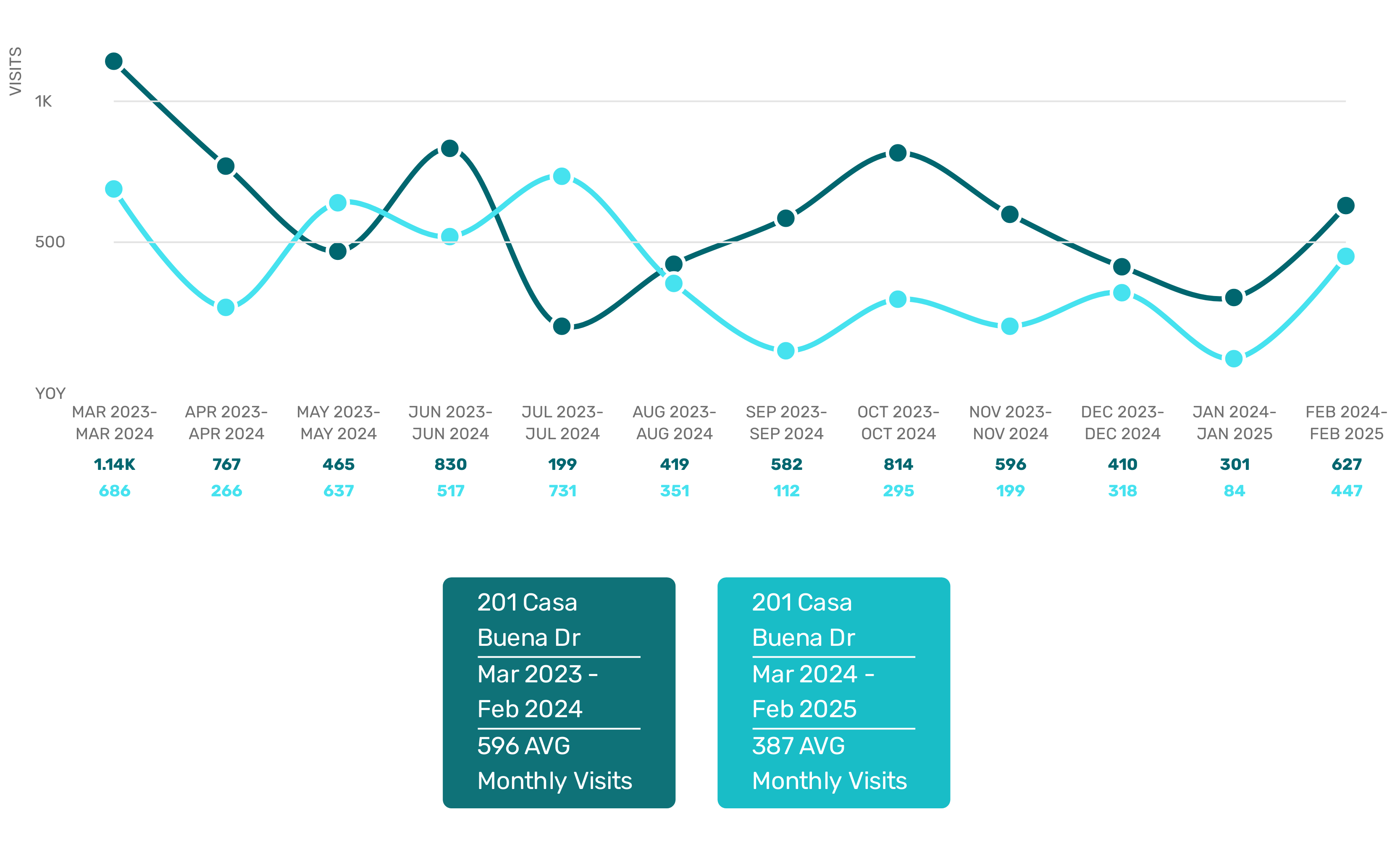

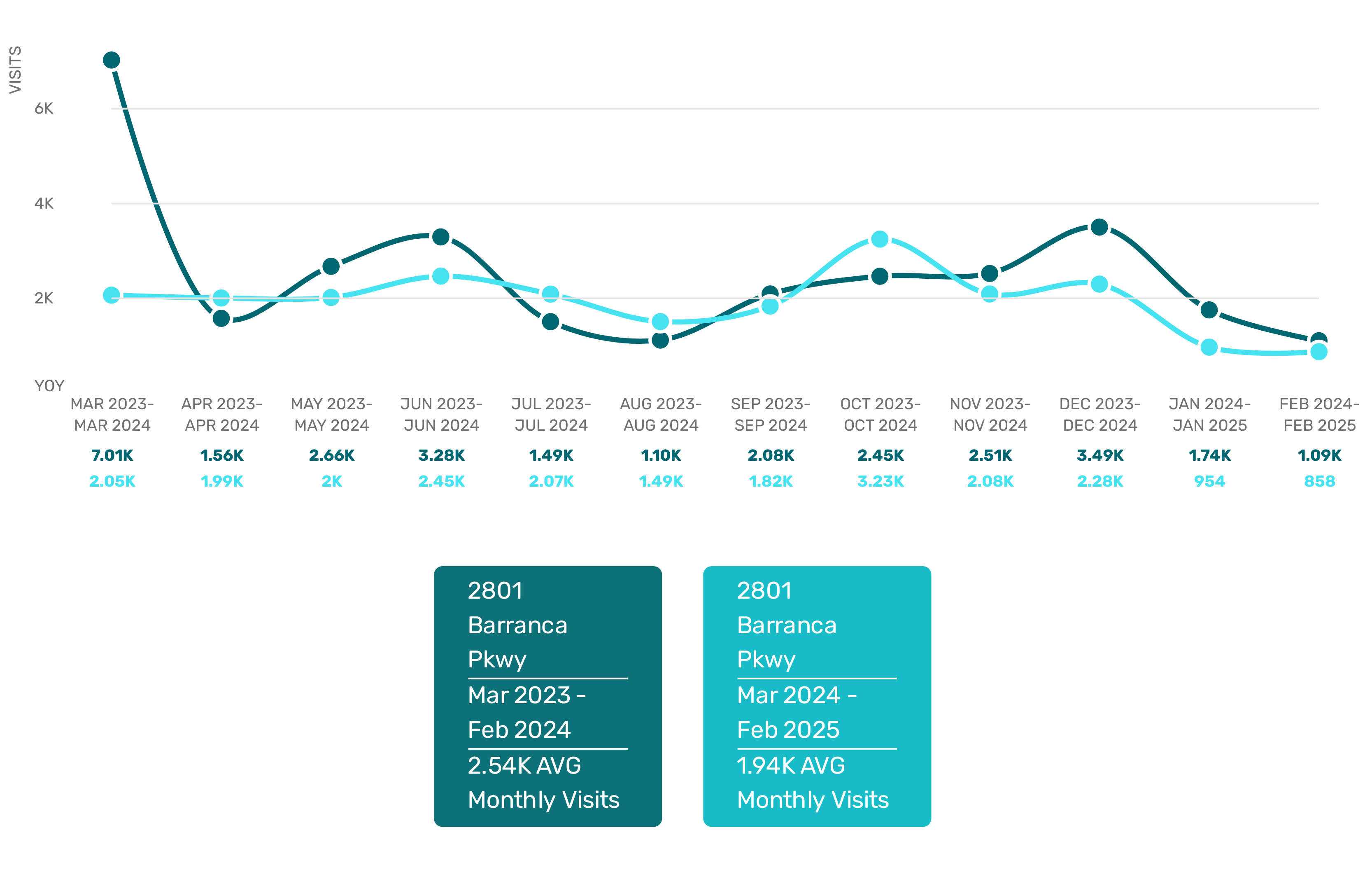

The chart above shows activity (in thousands of visits) to Tesla’s auto plants, besides Shanghai (for which Advan doesn’t have data). Visits could be an employee shift, a trailer pickup of finished vehicles, a delivery truck for rolled steel, or a maintenance delivery. As shown, activity is down for all three, with the pace worsening at Austin and Berlin thus far in 2025. The bars show activity per employee, and again, less activity. What is the demand signal that Tesla operations people are reacting to: less visits to its website, fewer longer visits to the showrooms, less purchase activity, and the like. Below we show “seriously considering” visits to two of Tesla’s more powerful showroom locations, Corte Madera in the Northern Bay Area and Irvine in SoCal. We define “seriously considering” to be visits between 15 minutes and 120 minutes in duration, by non-employees. As shown for these two showrooms, seriously-considering visits have been down since pre-election.

Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.

Follow us on Twitter and LinkedIn.

20250310_tesla_visits_201_casa_buena